Property Listings

Resilient Neighbourhood Investment Opportunity

- Modern Purpose Built Neighbourhood Centre

- Extending 2,744.91 sq.m. (29,546 sq.ft.)

- Excellent tenant line-up includes Musgraves Ltd (trading as Centra), Giraffe Childcare Ltd, McCabe's Pharmacy, Boylesports and Pizza Hut

- 5.88 years to break - 7.72 years to expiry

- High Occupancy Rate of 95%

- Net Operating Income of €682,406 per annum

- 94 Surface Car Parking Spaces

- Asset Management Opportunities on Purchase

Guide Price - €6,600,000 / NIY of 9.4% off NOI

- Flagship Store extending to 61,630 sq.ft

- Situated in the heart of O’Connell Street, Ireland’s premier thoroughfare undergoing significant transformation

- New 25 year lease to Eason’s Ltd at a passing rent of €1,341,500 per annum

- Tenant Break in year 10

- Quoting price €24,500,000, reflecting 5.00% Net Initial yield after purchasers costs

- BER Exempt

- Four retail units with prominent road frontage and standalone creche.

- Currently producing €163,375 per annum with a substantial reversionary potential.

- WAULT to break of 6.43 years.

- Tenants include Londis (BWG guarantee), Mizzonis Pizza, Pamper Yourself Salon and Giraffe Childcare.

- Immediate Value add opportunity from the letting of the vacant unit and through progressing rent reviews.

- Attractive initial yield of 7.84% (with one vacant unit) potentially rising into double digits after Value-add incentives.

- Two well located office blocks situated in a high-profile position on the Merrion Road, opposite St. Vincent’s University Hospital

- Extending to 4,016 sq m (43,235 sq ft) over two independent blocks with 83 under croft car parking spaces

- Passing rent of €1,439,932 per annum subject to variation in accordance with a range of ongoing lease events

- Blended WAULT of 4.46 years

- Medium to long term development opportunity to upgrade or re-purpose the existing buildings

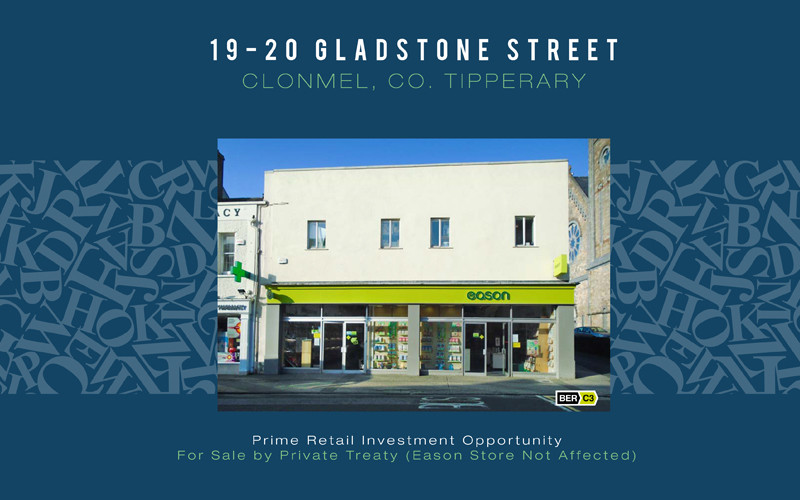

- Prime Retail Investment Opportunity

- For Sale by Private Treaty (Eason Store Not Affected)

- Situated in a prime high footfall location on Cork’s principal shopping street

- High profile building directly opposite Merchants Quay Shopping centre and M&S

- Substantial building of approx. 2,045.3 sq.m. (22,017 sq.ft) NIA

- 25 year lease to Eason Ltd. with 10 years term certain and parent guarantee

- Attractive Net Initial Yield of 7.0% off a market rent of €500,000 p.a.

- For Sale by Private Treaty on behalf of ESB Commercial Properties Ltd

- Super Prime Office Investment at the Centre of Dublin's CBD

- Unrivalled pitch with views over Merrion Square

- 12,599 sq.m (135,617 sq.ft) of new grade 'A' office space with 50 car spaces

- Occupied by Slack, an International Software Company

- Rent roll of €7.75m per annum

- New Long Term Lease

- Superb connectivity to Dublin's Public Infrastructure Hubs

- Practical completion due Q2 2020

- Situated in the heart of Limericks retail core opposite Penney’s and Debenhams

- High profile retail unit with frontage onto O’Connell Street and Cruise’s Street

- Entire extends to 1,168.1 sq.m (12,573 sq.ft) NIA

- 25 year lease to Eason Ltd. with 10 years term certain

- Attractive NIY of 7.5% off a market rent of €180,000 p.a.

- Prime Retail Investment Opportunity

- For Sale by Private Treaty (Eason Store Not Affected)

- High Profile location on Gladstone Street opposite Specsavers

- Two storey end-terrace building extending to 431.3 sq.m

- Large retail floor plate of 347.3 sq.m at ground floor

- 25 year lease to Eason Ltd. with 10 years term certain

- Attractive NIY of 11.5% off a market rent of €70,000 p.a.

- Prime Retail Investment Opportunity

- For Sale by Private Treaty (Eason Store Not Affected)

- Situated in a prime high footfall location on Galway City’s premier thoroughfare

- Landmark building directly opposite River Island and Tommy Hilfiger

- Uniquely large retail floor plates with the entire extending to 1,042.9 sq.m

- 25 year lease to Eason Ltd. with 10 years term certain and parent guarantee

- Attractive Net Initial Yield of 6.0% off a market rent of €525,000 p.a.

- Mid-terrace own door office extending to approx. 3,594 sq.ft

- For Sale with vacant possession

- Mix of open plan accommodation, cellular offices and large kitchen

- Excellent accessibility with close proximity to M50 & M7

- Good public transport links with numerous bus routes and LUAS nearby

- Established business park

- Includes six dedicated car spaces

- Cafés nearby include Chopped, Subway and Fude

- Two modern neighbourhood centres, both approx. 400m from N3, Navan Road (Ashtown roundabout) and adjacent to Ashtown Train Station in Dublin 15

- Net operational income (NOI) of €546,213 per annum and WAULT of 11.2 years (Oct ’17)

- 78% occupied by a variety of tenants including Lloyds Pharmacy, Spar, Giraffe, Bombay Pantry amongst others

- Potential to enhance returns through asset management and lease up of vacant space, currently 22%

- 3,601 sq.m (38,765 sq.ft) of modern commercial accommodation situated in expanding suburb 6 kms from the city

- Immediately adjacent extensive active and pipeline housing development

- Excellent road and rail Infrastructure offering platform for continued residential growth

- For sale in one lot with a quoting price of €5.85m reflecting a current NOI yield of 8.6%, after 8.46% purchasers costs

- For Sale by Private Treaty

- Prime retail investment located in the centre of Temple Bar, immediately adjacent Temple Bar Square

- Tourism and cultural heart of the City

- Two storey mid terrace property extending to 55.1 sq.m (593 sq.ft)

- Entirely occupied by Aunty Nellie's Sweet Shop under a 35 year FRI lease from June 2016 at a passing rent of €34,303 per annum

- Ground floor retail unit situated within Palmerstown Shopping Centre

- Situated adjacent to SuperValu customer entrance fronting onto a large surface car park

- Gross Internal Area of 115.8 sq. m (1,246 sq.ft)

- Occupied by South Dublin County Council

- 10 year lease from 1st April 2017

- Passing rent of €40,000 per annum

- For Sale by Private Treaty (Tenant not affected)

- Modern Neighbourhood Centre situated in an affluent commuter town

- Active housing development and zoned residential land in the immediate vicinity

- Excellent road and rail infrastructure provides platform for continuing population growth

- Weighted average unexpired lease term of 10.94 years offering secure income

- Significant asset management opportunities to enhance returns

- Two external retail units situated on busy thoroughfare between The Square and Tallaght Main Street

- Unit 135 is let to Domino’s Pizza with c. 9 years unexpired at €74,880 p.a. with upwards only reviews

- Unit 137/a is let to Mao at Home at low passing rent of rent of €25,000 p.a

- Potential for Mao rent to double in 2017 at rent review (or on re-letting as tenant has break)

- Both units have shares in the shopping centre management company

_1.jpg)

_(1)_0.jpg)

_0.jpg)